indiana tax warrants search

For general information regarding tax warrants please email Gloria Andrews or call 765-423-9388 ext. Just enter your name and see what comes back.

Our Custom Automation Helps Reduce Paperwork And Increase Revenue

Just Enter a Name and State.

. A sheriff that has an expired arrest warrant in Indiana must return the warrant to the clerk of court for the county in which it was issued. Ad You Can Now Find Warrant Records Online with a Simple Search. Ad Updated Find Arrest Warrants for Anyone - All States - Begin Free.

Instantly Reveal Criminal Records Including Warrants DUI Traffic and More. Criminal Warrants Civil Warrants Bench Warrants. Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week.

Although this is not a warrant for your arrest the information will appear on a credit report or title search and becomes a lien on your property. A Warrant lookup identifies active arrest warrants search warrants and prior warrants. If you wish to dispute the amount owed please contact the Indiana Department of Revenue directly in Indianapolis at 317 232-2165 or their Merrillville branch located at 1411 E 85th Ave Merrillville IN 46410 219 769-4267.

Indiana warrants can be found online so instead of worrying if you have any Indiana outstanding warrants take the time and do a search. Tax Warrants are issued by written letter never by telephone. These should not be confused with county tax sales or a.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. It is simple to do and will only take a couple of minutes. INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax warrant judgment docket is automatically created.

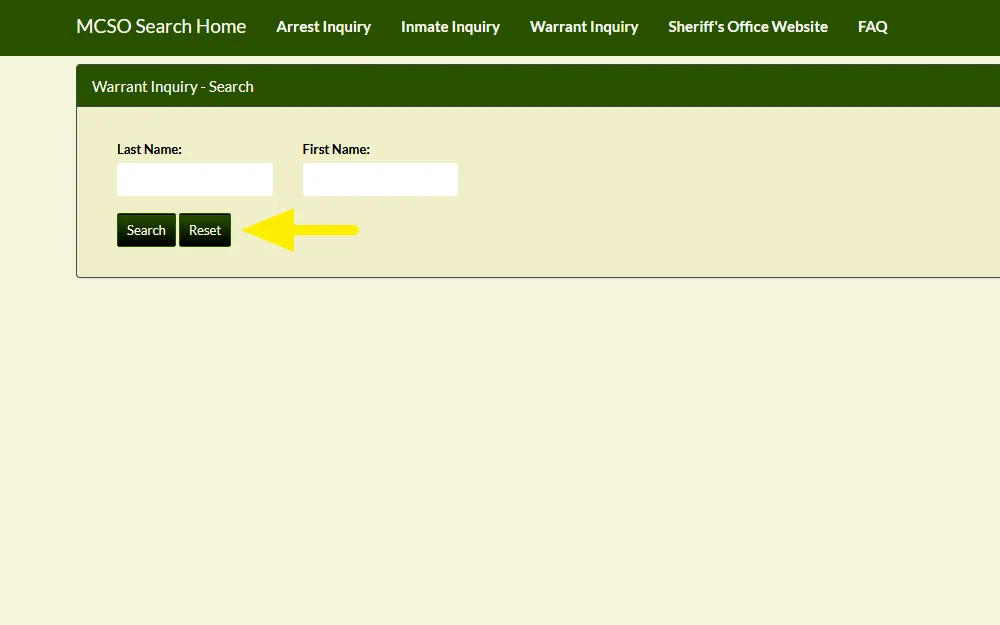

The site is very easy to use. Ad 2022 Updated US Database-Find Outstanding Warrants for Any Person. Tax Warrant for Collection of Tax.

As noted above if a tax warrant is challenged create a Miscellaneous MI case for the court proceedings. With a subscription to the Tax Warrant Application on INcite managed by the Office of Trial Court Technology users can get secure access to tax warrant information maintained by the Clerks of Court in 79 Indiana counties. Warrant types include individual business and workforce development where available.

Spencer County Tax Warrants Report Link httpsspencercountyingov171Auditor Find Spencer County Indiana tax warrant and lien information by delinquent tax payer name and case number. Our service is available 24 hours a day 7 days a week from any location. If you receive a written Tax Warrant follow these.

Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. A Tax Warrant is not an arrest warrant. A Indiana Warrant Search provides detailed information on outstanding warrants for an individuals arrest in IN.

Instead this is a chance to make voluntary restitution for taxes owed. If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. Yes a warrant for arrest on a misdemeanor expires 180 days after it is issued.

The clerk of court records that the warrant has expired without being served and notifies the countys prosecuting attorney. Tax Warrants The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana. Joseph County Indiana property tax.

Subscribe to Search Indianas Tax Warrant Database. Updated US Database-Find Outstanding Warrants for Any Person. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

Do not take chances. Doxpop provides access to over current and historical tax warrants in Indiana counties. AGREEMENT FOR E-TAX WARRANT SEARCH SERVICES The Indiana Supreme Court through its Office of Judicial Administration OJA and _____ Requesting Party hereby enter into this Agreement for an INcite accounts to access Tax Warrant Data Agreement maintained by.

We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. Warrants issued by local county state and federal law enforcement agencies are signed by a judge. For specific information regarding tax warrants please contact the Indiana Department of Revenue directly at 317-232-2240.

March 18 2022 0013. When you use one of these options include your county and the mandate number.

Idoc Indiana Department Of Correction Fugitives

Federal Warrant Search Lookup Guide For All 50 States The Bad News

Tax Warrants Perry County Government

Federal Warrant Search Lookup Guide For All 50 States The Bad News

Tax Warrants Tippecanoe County In

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

![]()

Federal Warrant Search Lookup Guide For All 50 States The Bad News

Faqs Automated Tax Warrant System

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Tax Warrants Perry County Government

Indiana Warrants Search Directory

9 4 9 Search Warrants Evidence And Chain Of Custody Internal Revenue Service

24 People Arrested 12 Search Warrants Served During Large Indianapolis Sweep Wttv Cbs4indy